We have updated our Lightspeed POS Inc. (LSPD.TO) presentation, updating our thesis to include further details on our segment forecasts and valuation.

Lightspeed (LSPD.TO) August 29, 2019, Institutional Investor SELL Pitch – Perspectec

We are making this presentation public for marketing purposes. Institutional Equity Research subscribers had access to an earlier version of this presentation on August 13, 2019.

We believe investors holding LSPD.TO should sell their shares. Our investment thesis is that:

- There are material headwinds Lightspeed’s growth strategy

- Lightspeed’s Customer Growth has (and will) come almost entirely from acquired platforms

- Organic customer location acquisition costs are high and rising

- Lifetime Value requires a Churn Rate – Our online survey shows an annual churn rate of 46%

- On a relative basis, Lightspeed’s churn rate was the lowest versus Square (SQ), Wix (WIX), Shopify (SHOP) and GoDaddy (GDDY)

- Our estimates have Lightspeed’s Customer Acquisition Costs (CAC= ~$6,000) being materially higher than their Customer Lifetime Value (CLTV =~2,800)

- An estimated 85% of revenue is generated by the retail/restaurant industry that is growing in the low single digits. We have not been able to identify reliable statistics on POS cloud industry growth

- Lightspeed’s changes in definitions obscure real customer growth

- Lightspeed Retail will begin (has begun?) to exhaust large numbers of OnSite customers that they can transfer to the cloud, thereby slowing reported customer location growth

- We expect an acceleration in funding at a low WACC to increase its customer base

- As a result of structurally high costs, Lightspeed charges higher prices relative to other brick & mortar options

- Mixed results from our door-to-door interviews with 24 stores and restaurants in Toronto

- Lightspeed Google Searches Worldwide show increases versus other POS Software Companies while reviews of Lightspeed Retail appear relatively negative

- By the same Google Trends measurement, omnichannel options (Cloud POS + eCommerce + Other) have a reputation and awareness edge globally, and their POS related solutions may be gaining share

- Many larger vendors are upgrading / Innovating their In-Store POS Solution in 2019

- Lightspeed Payments does take away the pain point of signing up with a payment processor for new stores, however, it may not make sense for existing stores due to not being a cheaper solution

- Similar to Customer Locations, Gross Transaction Volume (GTV) has been restated to exclude Lightspeed OnSite, inflating Lightspeed’s actual GTV CAGR

- Module expansion has the lowest barriers to entry and may be the easiest method to grow Gross Margins long-term, but key figures are not consistently disclosed and are therefore growth hard to track

- Creating value through acquisitions is expensive for shareholders

- M&A is helping to cover slowing growth

- Purchasing Customer Locations appears to be materially more expensive than organic Customer Acquisitions

- Providing annual revenue, EBITDA and Cash Flow from Operations targets locks Lightspeed into inefficient capital allocation in order to meet/beat its guidance

- Acquisitions will raise already high fixed costs. Despite <$100M in revenue, employees speak four languages and there are at least five non-sales/business development offices.

- Lightspeed will increasingly bump up against larger firms in bidding for Commerce Cloud acquisitions

- Management appears focused on sales growth vs. accounting for acquisition costs

- A POS industry specialist also disagrees with Lightspeed’s acquisition approach and notes past history

- On a historical, relative, and absolute basis, Lightspeed is expensive

- By historical metrics, LSPD is multiples times more expensive by almost any metric in comparison to the last major POS acquisition (MICROS acquired by Oracle for $4.6 billion)

- The argument for enterprise SaaS acquisitions is a lower churn rate. Lightspeed, however, does not disclose this figure and this is generally par for the course for Canadian technology companies

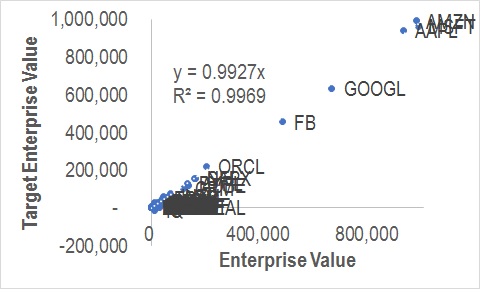

- Our Price Target is based on Gross Margin Dollar Growth, Lifetime Value, and Growth Costs. We use Shopify, Lightspeed, Wix, and GoDaddy as comparable Commerce Cloud Growth companies and our model has an r-squared of 0.998, an adjusted r-squared of 0.665 and Standard Error of $1.15 billion.

- We define Lifetime Value and Growth Costs that sell-side often ignore, using valuation metrics that match how recurring revenue-based companies operate.

- We expect a major Subscription Gross Margin dollar contribution from the iKentoo acquisition in Fiscal Q2/20 (September 2019 Quarter End). Offsetting this will be material acquisition costs from iKentoo (the amount was not disclosed in fiscal Q1/2020) that will not be captured Lightspeed’s guidance

- Lightspeed’s Lifetime Value/Growth Costs we believe will be primarily driven by the price paid for acquisitions

- The large majority of sustainable gross margin growth over the next year should come from Lightspeed Retail, Restaurants and Payments

- Prior to 2019, Shopify historically traded below 100x TTM Gross Margin Dollar Growth. While Shopify has seen their multiple raise to about 150x, Lightspeed’s has seen its multiple decouple from Shopify at a rate well beyond what we believe is fair value.

- Even if Lightspeed reaches a free cash flow levels of over $25 million, undergoing a re-rating to an Established Commerce Enablement company gets us to a fair value of $19 per share by 2023.

- Our Lightspeed price target of $31 per share is equal to 94x our fiscal 2020 (March 2020 year-end) estimated gross margin dollars added ($21.4 million) multiplied by its estimated TTM LTV Added/TTM GC of 1.05x. We convert this amount at a USD/CAD of 1.33 and divide this by 91.2 million diluted shares outstanding expected at the fiscal year-end.

- We rate LSPD.TO a SELL and believe investors should reduce their holdings of LSPD.TO now.

- Key Risks to Our Target

- A combined Lightspeed Retail, Restaurant and eCOM churn rate well below our 46% estimate, which was based on our Google Survey results would be a risk to our thesis. The current share price implies a lifetime (not-customer) value churn rate of about 30%.

- The price for acquisitions is materially lower than we forecast. This includes the recently acquired iKentoo

- Fund flows continue to move heavily and indiscriminately into the Commerce Cloud Growth space

- Lightspeed is able to merge development and support of iKentoo as well as with future acquisitions easily and that this strategy leaves Lightspeed with a long-term WACC well below that of competitors

- Other Notes

- Perspectec Analysts and Associates are not allowed to trade their research coverage

- Perspectec does not seek any revenues from the companies under our coverage universe

- This research is not sponsored by any 3rd party firm

Feel free to reach out with any questions or comments at (416) 898-8546.