This is the first in an ongoing series of research pieces examining Netflix’s (NFLX-NASDAQ) business and share price. Unlike their programming, there will be no end date to our research unless the company is acquired.

We view Netflix revenue and content costs similar to the way the company does, taking into account U.S. and International churn, customer lifetime value and customer acquisition costs.

In order to help answer some key questions, we surveyed over 600 hundred people in the U.S. and Mexico, with a goal of helping to answer questions we had surrounding market penetration, pricing, content, competition and subscriber churn.

In order to help us determine the impact content may have on subscriber growth, we have tracked all of Netflix’s original programming on Google trends.

The inputs from the survey and Google trends helped us come up with what we believe is a strong enough quantitative model of the subscriber impact on original programming on Netflix.

The purpose of undergoing this research is to help us determine the future direction of NFLX relative to another subscription stock. The highest risk/reward forecast we can make on NFLX’s price movement is anticipating the next few quarter’s net subscriber additions and other SaaS metrics. Unexpected changes in net subscriber additions can lead to changes in the trajectory of revenue, future cash flows and a re-valuation of the stock price by buy-side and sell-side.

We believe Netflix’s share price will move higher. This is based on the company’s current EV/EBITDA, subscriber growth rate and estimated Customer Lifetime Value (“CLTV’) / Customer Acquisition Costs (CAC).

In the absence of a change in expectations, technicals may also be important.

An example of Customer Lifetime Value – Why does Customer Lifetime Value matter?

CLTV is exactly as it sounds. What is the value of a company’s average subscriber. The formula for CLTV is the annualized gross margin of an average paying subscriber for the last reported period divided by the rate at which an average paying subscriber leaves the platform (annual churn).

Customer Lifetime Value (CLTV) = Gross Margin of Subscribers / Churn

If the marginal CLTV is greater than the Customer Acquisition Costs (CAC), then there may be more profitable growth ahead. The larger the ratio the better.

Customer Acquisition Costs (CAC) = Marketing Costs / Total Paying Subscribers

For example, if Verizon Wireless receives $50 a month from its smartphone subscribers, and the cost of providing that service including running data over the network, overhead from a Verizon store, customer care, etc is only $12 a month, given a normal 1% monthly churn rate, this customer is worth $3,800 to Verizon!

EXHIBIT 1: Profitable Business Model

Source: Perspectec

This has been the moto of the likes of Salesforce.com, Mobile Iron, Amazon Prime and any other subscription type service you can think of. Analyzing this ratio and other SaaS metrics can give you a leg up on a company’s future earnings potential, something that investors have realized a little late with the likes of Salesforce.com, Adobe, Workday, ServiceNow, Kinaxis and dozens of other SaaS companies. Of course, if a churn rate begins to accelerate, or the company sets unrealistic expectations of subscriber growth, this has translated into a company overspending on sales and marketing and missing profitability targets by wide margins. Real life examples of this include Mobile Iron and Halogen Software. This figure is typically the most important number subscription companies normally do not report.

Our two surveys indicate a roughly 20% annual churn for Netflix in the Americas. Content was said to be the most important factor for churn after price – According to our survey, about 17% of U.S. subscribers and 23% of Mexican subscribers have left the platform over the last 12 months. The raw survey results are shown below in Exhibits 1 and 2.

EXHIBIT 2: Raw Survey Results of U.S. Market

Source: Google Surveys, Perspectec

EXHIBIT 3: Raw Survey Results of Mexican Market

Source: Google Surveys, Perspectec

Source: Google Surveys, Perspectec

The margin of error from our surveys was about 6%. The primary reasons why users left Netflix are due to (in order):

- The price (the #1 reason in both the U.S. and Mexico)

- The free trial period ending (the #3 reason in Mexico)

- The lack of engaging content (the #2 reason in Mexico)

- Competition from other platforms

With no indication of a pricing change in the near future after ending of grandfathered pricing last year, the largest impact to future net subscriber additions moving forward according to our surveys will likely be from the lack of (quality) content on Netflix.

Netflix has hinted in the past that their U.S. churn is above that of cable companies, which is in-line with what Wall Street analysts estimate. Cable company monthly churn is generally thought to be in the low single digits but well above the churn for Verizon Wireless’ postpaid customer annual churn (mostly 2-year contracts) of about 15%. However churn is definitely not approaching Verizon’s prepaid plan annual churn at 70%, which includes restless customer base with cheaper and a lot of choices. Pandora is also facing intense competition from the likes of Apple, Spotify, Soundcloud and dozens of others and sees annual churn at about 50%. Netflix does not see anywhere near that competition and with its unique content.

We believe this 20% figure translates to fewer subscribers leaving the platform than what most people expect.

Management’s content expenditures indicate they still benefit from great economies due to a customer’s lifetime value (CLTV).

Netflix U.S. subscribers CLTV were worth $343 each in Q2. Their International subscribers are worth $77 and their company-wide subscribers are worth $195 per subscriber. Assuming a steady churn, the CLTV is steadily going up. We believe churn is likely moving down, increasing the rate of growth of CLTV, although we have no proof of this at the moment.

The costs to acquire one U.S. subscriber was $78 in Q2, $41 to acquire an International subscriber, while the company wide average was $51. Post the removal of grandfathered pricing, these costs are generally up from a year ago but down from two years ago. Overall, they have remained remarkable steady.

EXHIBIT 4: Netflix’s Estimated TTM SaaS Ratios

Source: Google Surveys, Netflix, Perspectec

With a rising CLTV and generally steady CAC, the CLTV / CAC appears to be increasing. Therefore we see little signs that Netflix is facing pressure to grow profitably. This is different from other established companies who are seeing a natural decline in their CLTV / CAC.

EXHIBIT 5: Netflix and peer SaaS Metrics

Source: Perspectec, Company Reports

Netflix’s has noted their strategy for prospective subscribers is for them to hear about original shows such as House of Cards and Orange is the New Black through word of mouth or advertising. After hearing about a number of shows of interest, the prospect reaches a “tipping point” where he or she signs up for the service. Word of mouth has likely helped to reduce their advertising expenditures, CAC and improve valuation.

Netflix spends hundreds of millions every quarter on digital and television advertising including TV commercials, Facebook and Twitter. They also spend a material amount on partnerships such as their Comcast agreement to have their traffic carried over Comcast’s network as well as having their App on a set-top box. These include a fixed fee and/or revenue sharing payments. Netflix is working on such a partnership with iQiyi as an attempt to enter the Chinese market. We shall analyze the impact of this deal once details are made public.

One fair argument against this valuation is that Netflix’s current expenditures for content are increasing at a faster rate than the amortized cost of programing. While this is true, the content appears to be having longer amortization periods with an increasing number of returning shows. We will look at the actual expenditures of content versus amortization in future research.

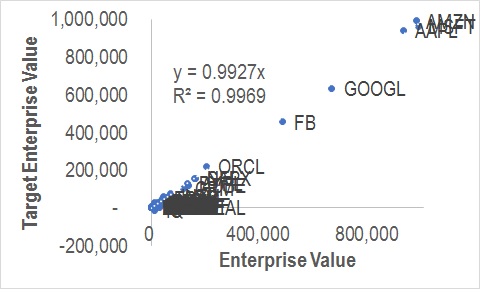

EXHIBIT 6: SaaS Growth Versus Valuation- Netflix and peers

Source: Perspectec, Company Reports

Taking all of these factors into account and looking at Exhibit 6, we believe Netflix is a buy over the next 12 months. Our Survey indicates churn of 20% annually is lower than cable churn, which is generally thought to be 30%+. The implication is that as Netflix churn awareness improves, its share price will continue to move higher.

We have performed a multiple regression analysis and determined a forecast model we believe reasonably estimates net subscriber additions

We have collected and categorized Google Trends search history of each major series relative to Netflix’s most popular show, 13 Reasons Why. Our preliminary multiple linear regression model includes:

– Systematically categorizing and weighting their most popular programming. Heavier weightings are given to returning shows and recent quarters. We have excluded kids shows and comedy specials. The shows in aggregate appear to help consumers reach a “tipping point” where the overall positive impact from all shows eventually causes a user to subscribe.

– Adjusting for saturation in the U.S. and International markets using an adjusted normal curve. U.S. subscribers are at 50 million subscribers vs. a 60 to 90 million opportunity. The international market with roughly the same number of subscribers is materially earlier in its adoption curve with a 3.1 billion potential subscriber opportunity.

– Adjusting for seasonality – Winter months typically see higher net subscription adds both in the U.S. and Internationally. It appears churn increases in the summer.

– Local language – Netflix has noted some local language content is making a big impact in certain countries. Given the lack of history, the impact is assumed to be linear. A survey is the likely pathway to more visibility here regarding weighting of future original local language content.

Future Adjustments

– Adjusting for internet speeds – We use Netflix data on a qualitative basis. We assume improvements Globally contribute to a consumer reaching a “tipping point” in eventually subscribing to Netflix.

– Comedy and Kids-oriented Programing – Potentially include in our analysis after getting a better answer through surveys.

Model Conclusions

This multiple regression model was statistically significant with an adjusted r-squared of 0.99 and a small but material enough 16 degrees of freedom. A summary of the regression model and Q2/17 estimate is provided in Exhibit 7.

Netflix has stated they are still attempting to get a better grip on a show’s impact on subscribers, but we believe Netflix history is reaching the point where we can use a multiple regression model to a large extent in forecasting net subscriber additions/subtractions.

EXHIBIT 7: Netflix Original Content Search Interest vs. Net Additions

Source: Google Trends, Netflix and Perspectec

Estimated Impact to Q2 Results

Based on this model, we estimate Q2’s net adds to be 3.62 million as opposed to management’s guidance of 3.2 million. We believe Netflix should be purchased prior to the Q2 report.

The model takes into account google trend data until June 18th and adjusts for noise (data that is not meaningful). In our opinion, the additional 0.42 million subscribers will come entirely from international streaming revenue. The impact to the U.S. market should be minimal due to its current saturation.

Working with an expected subscriber growth of 3.62, we estimate Q2/17 revenues to be $2,785 million. With the cost of House of Cards shifted from Q1 to Q2, we expect the gross and operating margin to be 31.0% and 4.6% respectively. Based on these numbers, we expect EPS for Q2 to be $0.16.

Q2 content mix should be a positive to U.S. net subscriber additions – Based primarily on Google Trends, our model forecast the following shows contributed heavily towards the 1.3 million of the quarter’s Global net additions over just the first three weeks of Q2 2017.

- Marvel’s Iron Fist (premiered March 17)

- Ingobernable (premiered March 24)- Spanish language

- 13 Reasons Why (premiered March 31)

Other major shows that are expected to have a major impact in the quarter include:

- House of Cards season 5 (premiered May 30)

- Orange Is The New Black season 5 (premiered June 9)

- Sense8 season 2 (premiered May 5)

- Girlboss (premiered April 21)

- Las Chicas Del Cable (premiered April 28)- Spanish language

These relatively strong additions are the primary reason why we expect Q2/17 North American net additions to not drop by at least 1 million Q/Q for the first time since Netflix began reporting net subscriber additions in 2011.

Last year Q2 saw the end of grandfathered lower priced plans, which pushed net subscriber additions below 1 million Q/Q. We are discounting the impact of new shows materially (20% the impact on returning shows) and the possibility that these shows can increase net subscriber growth remains very real to potentially likely.

Q3 should be strong – While Q2 net subscriber additions are expected to be strong, Q3 looks to be even more solid. Two highly anticipated shows are expected to premier in Q3 2017, Marvel’s The Defenders (August 18) and Narcos season 3 (TBA). Based on our model, we predict subscriber guidance of 4.4 million. Depending on the actual results for Q2 and the announcement of new series for the quarter and the performance of these series, we shall be updating our subscriber estimate periodically.

Conclusion

We believe Netflix should be bought based on their current, relative CLTV / CAC and EV / EBITDA. Based on our surveys we believe investors have underestimated Netflix’s churn, a key SaaS valuation metric. Perspectec is willing to offer subscribers their money back if Netflix share price decreases over roughly the next year. See our subscription plans for more details.

In the short-term, we expect both Q2 and Q3 net subscriber additions to be strong based primarily on the stronger than expected impact of new shows (primarily “13 Reasons Why”). Net subscriber additions are the biggest driver to Netflix valuation due to the average subscriber being worth over 7x the increase in revenue.

While we are gaining confidence in our forecast model estimating Q2 and Q3 forecasts, we are not offering a money back offer on a stock call related to buying NFLX before the Q2 earnings release and selling it right after the release.

Important Disclosures and Disclaimer

This publication is produced by Perspectec Inc. This publication and the contents hereof are intended for information purposes only, and may be subject to change without further notice. Any use, disclosure,

distribution, dissemination, copying, printing or reliance on this publication for any other purpose without our prior consent or approval is strictly prohibited. Neither Perspectec Inc. nor any of its respective parent, holding, subsidiaries or affiliates, nor any of its respective directors, officers, independent contractors, servants and employees, represent nor warrant the accuracy or completeness of the information contained herein or as to the existence of other facts which might be significant, and will not accept any responsibility or liability whatsoever for any use of or reliance upon this publication or any of the contents hereof.

No publications, nor any content hereof, constitute, or are to be construed as, an offer or solicitation of an offer to buy or sell any of the securities or investments.

This research report is not to be relied upon by any person in making any investment decision or otherwise advising with respect to, or dealing in, the securities mentioned, as it does not take into account the specific investment objectives, financial situation and particular needs of any person. Please refer to Persepctec Inc.’s terms of use disclosure and privacy policy https://perspectec.com/term_of_use

|

RATING |

CURRENT RATING |

PREVIOUS RATING |

|

BUY |

✓ |

n/a |

|

HOLD/NEUTRAL |

n/a |

|

|

SELL |

n/a |

For the purposes of complying with NYSE, NASDAQ and all Self-Regulatory Organizations, Perspectec Inc. has assigned the following rating system BUY, HOLD/NEUTRAL, SELL for the securities which are the views expressed by an analyst, Independent contractor, and or an employee of Perspectec Inc. The information and opinions in these reports were prepared by Perspectec Inc. or an analyst, independent contractor. Though the information herein is believed to be reliable and has been obtained from public sources believed to be reliable. Perspectec Inc. makes no representation as to its accuracy or completeness.