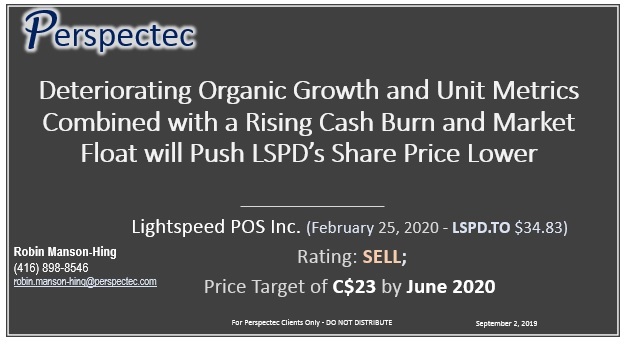

We have launched coverage on Lightspeed POS Inc. (LSPD.TO) with a SELL rating and a price target of C$30. We use lifetime value-added (LTV added) as a base metric gathered through online surveys. In addition, we conducted 22 in-person interviews with retail stores and restaurants across Toronto to get a better sense of customer satisfaction with their product relative to competitors. These methods were used in conjunction with Lightspeed’s gross margin dollar growth relative to its public peer group to come to a fair value for Lightspeed.

On a stand-alone basis, Lightspeed’s lifetime value-added divided by its customer growth costs (CGC) are well above average in relation to other larger North American public cloud platforms catering to SMB commerce. However, we do not believe LSPD’s LTV added/CGC is high enough to justify its current stock price. We believe further buy-side awareness will bring the share price down towards C$30 over the coming months.

Relative Lifetime Value Added Metrics divided Customer Growth Costs

Source: Perspectec

We have also upgraded our target on Shopify to a BUY rating with a price target of $414. This is also based on updated lifetime value-added metrics in conjunction with gross margin dollar growth and relative valuations. We believe the share price will continue to move higher until 2020 guidance is provided. At that time material fulfillment costs begin to come into focus and the risks to buy SHOP we believe will increase materially.

Our 22-slide executive summary is available below for free. Our full presentation is available for Institutional Equity Research subscribers only.

North American 3rd Party Commerce Enablement – Executive Summary – Perspectec